Financed Emissions: A Comprehensive Guide to Measurement and Reporting

18.11.2024

·

Maddalena Castelli Dezza

Financed emissions refer to the greenhouse gas (GHG) emissions associated with the investment and lending activities of financial institutions. These emissions derive from the operations of companies within a financial institution's portfolio, with the emissions share allocated based on the proportion of each company’s activities that the institution finances.

According to the Greenhouse Gas (GHG) Protocol, emissions are divided into three main categories, or "scopes":

Scope 1: Direct emissions from sources directly owned or controlled by the company, such as company owned vehicles and fuel based heating systems.

Scope 2: Indirect emissions from the generation of purchased electricity, steam, heating, and cooling.

Scope 3: All other indirect emissions throughout the value chain, including activities not directly managed by the company. Scope 3 is further broken down into 15 sub-categories.

Financed emissions fall under Scope 3, sub-category 15, which specifically accounts for emissions from investments and lending activities.

Companies typically required to disclose their financed emissions include banks, insurance firms and asset managers.

What is PCAF?

The guidelines for measuring and reporting financed emissions are outlined in the Global GHG Accounting and Reporting Standard for the Financial Industry, developed by The Partnership for Carbon Accounting Financials (PCAF). PCAF is an industry-led initiative that aligns with the GHG Protocol Corporate Accounting and Reporting Standard, providing a framework for financial institutions to accurately measure and report the greenhouse gas emissions resulting from their lending and investment activities.

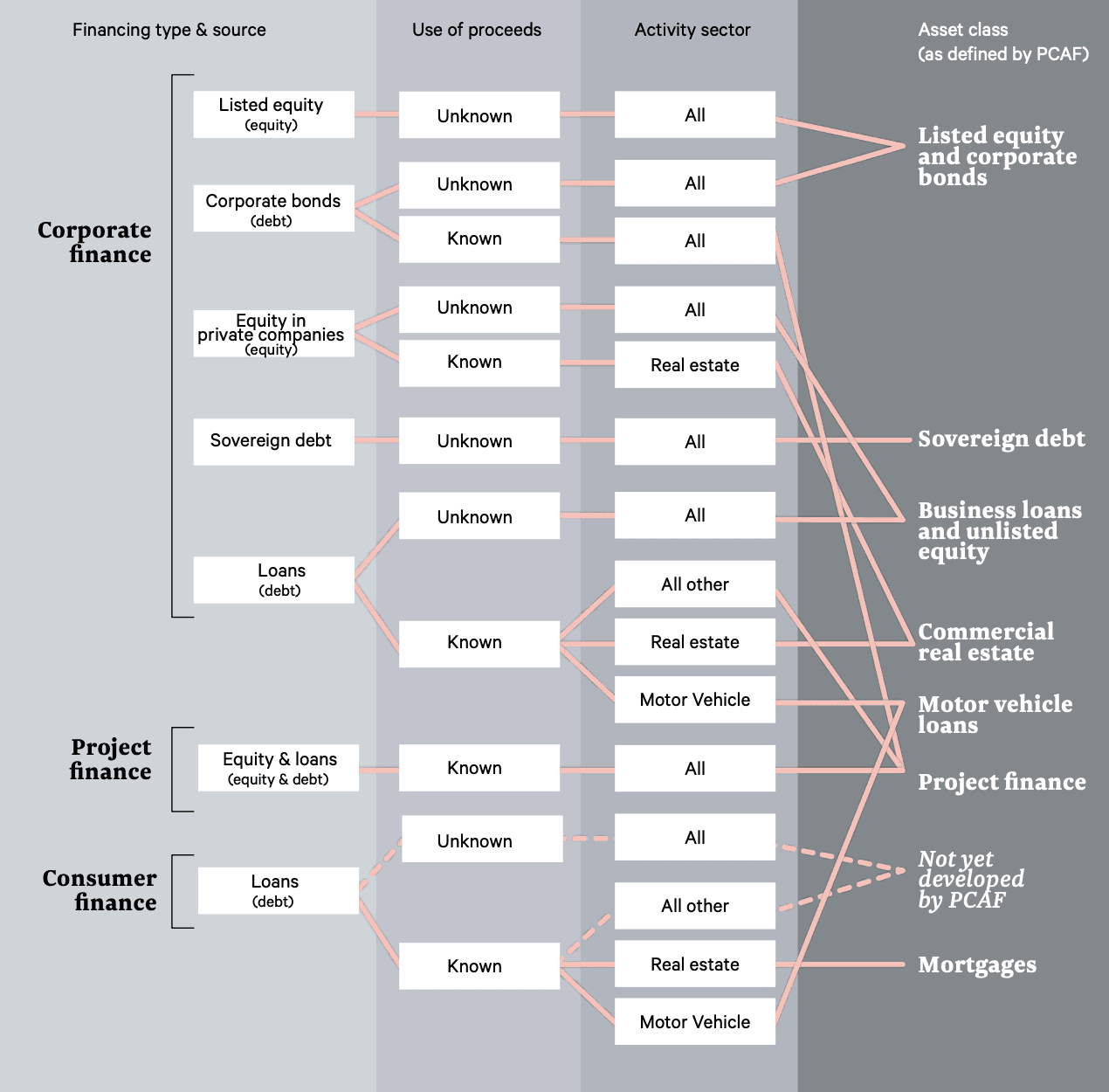

The latest iteration of the standard offers guidance for seven asset classes:

Listed equity and corporate bonds: This category covers all on-balance sheet listed corporate bonds and equities traded on a market for general corporate purposes (i.e., unknown use of proceeds), including:

All types of corporate bonds for general corporate purposes

Common stock

Preferred stock

Business loans and unlisted equity: This asset class covers business loans and equity investments in private companies, also known as unlisted equity. It includes all on-balance sheet loans and lines of credit to businesses, nonprofits, and other organizations that are not traded on a market and are for general corporate purposes. Unlisted equity refers to all on-balance sheet equity investments to businesses, nonprofits, and other organizations that are not market-traded and are for general corporate purposes.

Project finance: This category includes all on-balance sheet loans or equities designated for specific projects or activities with known use of proceeds, as defined by the GHG Protocol. This can include, for example, financing for the construction and operation of gas-fired power plants, wind or solar projects, or energy efficiency projects.

Commercial real estate: This asset class includes on-balance sheet loans for specific corporate purposes, specifically the purchase and refinance of commercial real estate (CRE), as well as on-balance sheet investments in CRE where the financial institution does not have operational control over the property. These properties are used for commercial purposes such as retail, hotels, and office spaces.

Mortgages: This class includes on-balance sheet loans for specific consumer purposes, namely the purchase and refinance of residential properties, including individual homes and small multifamily housing units. These properties are used for residential purposes, not commercial activities.

Motor vehicle loans: This asset class refers to on-balance sheet loans and lines of credit to businesses and consumers for specific (corporate or consumer) purposes - namely the finance of motor vehicles. There is no specific list of vehicle types falling within this asset class. The financial institution shall define the types of vehicles included in their financed emissions inventories and provide transparent explanations for any exclusions.

Sovereign debt: This asset class covers sovereign bonds and loans of all maturities issued in domestic or foreign currencies. These loans and bonds involve transferring funds to the borrowing country, creating a debt obligation to be repaid. Sub-sovereign and municipal counterparties are excluded due to limited data availability and their lack of direct subjectivity to international GHG emissions inventory standards.

The graphic below, sourced from the Global GHG Accounting and Reporting Standard for the Financial Industry, provides an overview of various asset classes and offers guidance on selecting the appropriate approach for calculating financed emissions.

Why measure financed emissions?

Measuring financed emissions enables financial institutions to directly engage with the climate risks and opportunities associated with their investment portfolios, actively supporting the global transition to a net-zero economy. By tracking these emissions, institutions can more effectively allocate capital toward sustainable solutions and identify sectors making the fastest progress toward decarbonization.

Furthermore, In the European Union, the EU Taxonomy Regulation requires that financial market participants and advisors disclose how their activities align with environmental objectives, including climate change mitigation. This includes reporting on the carbon footprint of their investments.

How financed emissions are calculated?

Calculating financed emissions involves specific methodologies tailored to each asset class. The emissions scopes included in each asset class can vary, and the formula used to attribute emissions also depends on the asset class. Each methodology requires different emissions data points, which can have various levels of validity and quality.

Generally, emissions from investments should be allocated to the reporting company based on its proportional share of investment in the investee. Since investment portfolios are dynamic and can change frequently throughout the reporting year, companies should identify investments by selecting a fixed point in time, such as December 31 of the reporting year, or by using a representative average over the course of the reporting year.

Example: Overview of the methodology for Business loans and unlisted equity

Financial institutions are required to report the absolute Scope 1 and Scope 2 emissions of borrowers and investees across all sectors. For sectors where Scope 3 emissions reporting is necessary, these absolute Scope 3 emissions shall be disclosed separately, including the specific sectors covered.

Attribution of emissions

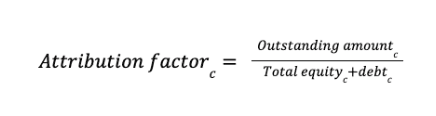

The principle for attributing emissions involves the financial institution accounting for a portion of the annual emissions of the borrower or investee. This portion is determined by the ratio between the outstanding amount (numerator) and the value of the financed company (denominator), known as the attribution factor.

For business loans and equity investments to/in private companies:

For business loans to listed companies:

Where:

The Outstanding amount is the actual outstanding loan amount.

For business loans,this is defined as the value of the debt that the borrower owes to the lender.

For unlisted equity (i.e., equity investments in private companies), the outstanding amount is the outstanding value of equity that the financial institution holds in the private company.

Total equity + debt is the sum of total company equity and debt, which can be found on the client’s balance sheet.

EVIC is the company enterprise value including cash.

C is the borrower or investee company.

The equation to calculate financed emissions is:

Emissions data

PCAF outlines three options to calculate the financed emissions from business loans and unlisted equity, based on the type of emissions data used:

Option 1: Reported emissions, verified or unverified emissions are collected directly from the borrower or investee company and allocated to the reporting financial institution using the attribution factor.

Option 2: Physical activity-based emissions, emissions are estimated by the reporting financial institution based on primary physical activity data collected from the borrower or investee, then allocated using the attribution factor.

Option 3: Economic activity-based emissions,emissions are estimated by the reporting financial institution based on economic activity data from the borrower or investee (e.g., revenue or assets in euro/dollars) and allocated using the attribution factor.

By following these methodologies, financial institutions can accurately attribute and report the emissions associated with their business loans and unlisted equity investments.

Challenges in measuring financed emissions

Financial institutions face several challenges in accurately measuring their financed emissions:

Data availability: Gathering comprehensive data on emissions associated with investments can be complex. Financial institutions often have portfolios spanning multiple asset classes, sectors, and geographies, making it challenging to collect data from various sources.

Limited access to GHG data: Engaging with investee companies and obtaining their emissions data can be a significant challenge. Some companies may not measure GHG emissions at all, and even those that do, may not share this information publicly.

Data quality: Assessing the reliability of emissions data can be challenging, as inaccuracies, omissions, or incomplete reporting can lead to inconsistencies and limit comparability across companies.

How can financial institutions start measuring their financed emissions?

The following steps provide a practical starting point and guidance for collecting and calculating financed emissions data:

Establish a clear methodology: Adopt a standardized approach, such as PCAF methodology, to ensure consistency in measuring and reporting financed emissions across your portfolio.

Engage with portfolio companies: Proactively reach out to companies within your portfolio to request emissions data and encourage transparent reporting.

Use industry benchmarks and proxy data: When direct data isn’t available, consider using industry averages or estimates as a temporary solution to fill data gaps.

Invest in data management tools: Implement specialized data management and tracking systems to efficiently collect and monitor emissions data across diverse asset classes and geographies.

Continuously review and update data collection practices: Regularly refine your data collection and calculation processes to improve accuracy in emission measurement.

At Atlas Metrics, we are here to help you navigate the complexities of calculating your financed emissions and Scope 3.15 across various asset classes. Our approach is based on the latest PCAF guidelines, offering solutions to simplify data collection and ensure accuracy.