KFW Capital & Atlas Metrics join forces to support the EU sustainability transition

30.11.2023

·

Lauren Maupetit

Asset managers have a key role to play in the urgently required sustainability transition. After all, an investment is both an approval of a business model and a commitment to an effective administration of fiduciary duties. ESG data is therefore reshaping investment strategies, helping investors understand their portfolios’ performance and being a crucial value-driver for investee companies. To support the ecosystem to fully harness the benefits of ESG data while minimizing effort, KfW Capital and Atlas Metrics are excited to announce a partnership, combining in-depth expertise with leading technology.

The benefits of ESG extend beyond SFDR compliance: it makes portfolio companies more resilient

ESG KPIs translate into real-world impacts on a company's market position, talent management, risk mitigation, and capital accessibility. Companies that excel in their ESG practices often find themselves ahead in the market, attracting top talent, managing risks more effectively, and securing capital on more favorable terms. For example, according to a LinkedIn survey, 71% of professionals said they would be willing to take a pay cut to work for a company that has a mission they believe in and strong sustainability practices.

In the European Union, the Sustainable Finance Disclosure Regulation (SFDR) has set new benchmarks for ESG transparency. Compliance with SFDR, particularly Articles 8 and 9, is now a key focus for investors (as of July 2023, among approximately 30 major asset managers, the adoption of Article 8 and 9 funds has increased from 47% to 78% since the implementation of SFDR). These classifications require detailed disclosures about financial products promoting ESG characteristics (Art. 8) or targeting sustainable investment objectives (Art. 9).

For portfolio companies, it's a proactive step towards meeting future reporting requirements. Getting started with ESG reporting from an early stage is a strategic move to prepare for an impending wave of regulations, including the Corporate Sustainability Reporting Directive (CSRD), Carbon Border Adjustment Mechanism (CBAM), and EU Taxonomy. Within the next 2 years, most European companies will be–either directly or indirectly–in scope to report over 100 sustainability KPIs in a compliant and machine-readable format annually.

ESG standardization progresses, practical challenges remain

We are witnessing the early stages of a journey towards full transparency in sustainability performance and reliable measurement of the impacts of economic activities. This path is guided by a set of increasingly standardized KPIs, developed through the collective efforts of regulators, industry leaders, think tanks, and a dynamic feedback culture between investors and investees. With investments in over 100 funds and around 2,000 companies, KfW Capital has been at the forefront of this movement, closely collaborating with entities like Invest Europe or VentureESG.

“KfW Capital is convinced that the identification of major ESG risks and opportunities as well as their management constitute key elements for the enduring success of companies,” says Theresa Bardubitzki, Sustainability Manager at KfW Capital. “In order to maintain an overview of our portfolio even after due diligence, to have necessary data for regulatory disclosure requirements and to promote dialogue between funds and portfolio companies, we started ESG reporting for the first time in 2023. The first year has provided many exciting insights into ESG data availability and quality and where the market stands. We are now looking forward to further professionalizing our ESG reporting through our collaboration with Atlas Metrics.”

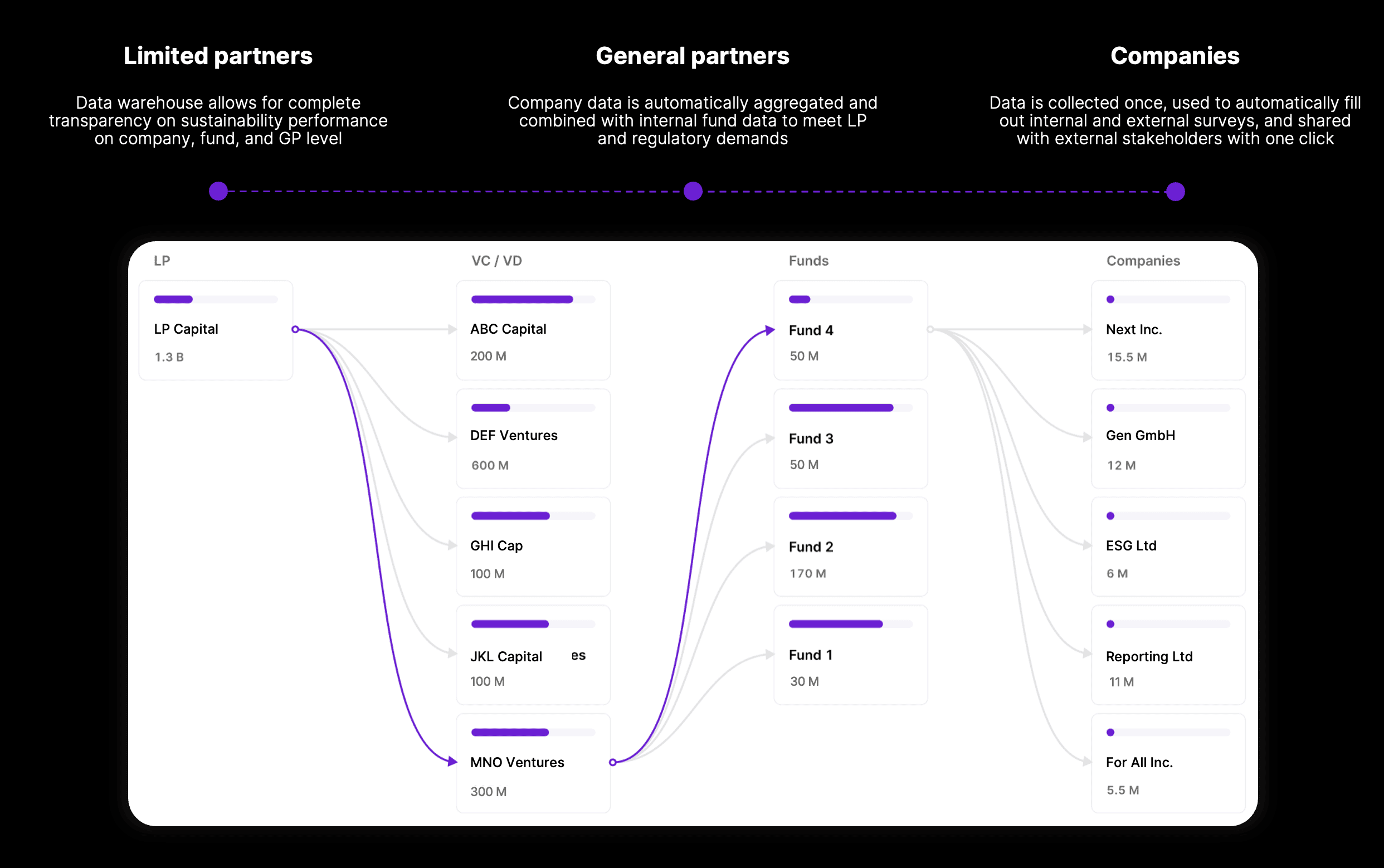

The collaboration between KfW Capital and Atlas Metrics unlocks real-time data exchange across the entire investment chain

The heart of the collaboration between KfW Capital and Atlas Metrics is to create transparency on the sustainability performance of funds and companies across the flow of capital while making ESG reporting as efficient and beneficial as possible for all parties involved. Portfolio companies can use the Atlas platform to exchange data with suppliers, investors, banks, and customers. They can also complete their CSRD journey end-to-end with the help of platform modules for double materiality analysis, carbon accounting, EU taxonomy assessment, auditing, and machine-readable reporting. General partners (GPs) can automatically aggregate and compare company data, engage companies on sustainability-related risks and opportunities, and leverage ESG data for LP reporting and fundraising. Limited Partners (LPs) benefit from powerful data warehouses that allow them to easily compare the performance of investments, and identify sustainability drivers at company, fund, and GP level. Everyone benefits from an intelligent data model, benchmarks, and AI-enabled automation to shift resources from reporting to management.

“So far, answering investor surveys has brought too little benefit for responding companies. The partnership with KfW Capital is a true gamechanger, as every organization can now automatically use the reported data to build up their own ESG system." says Atlas Metrics CEO Wladimir Nikoluk.

The success of the sustainability transition depends on solving a series of interconnected challenges through effective collaboration. To this end, KfW Capital and Atlas Metrics are excited to jointly contribute to making sustainability measurable and ultimately manageable as from the next reporting period starting in January 2023.